Ready to Transform Your Financial Future?

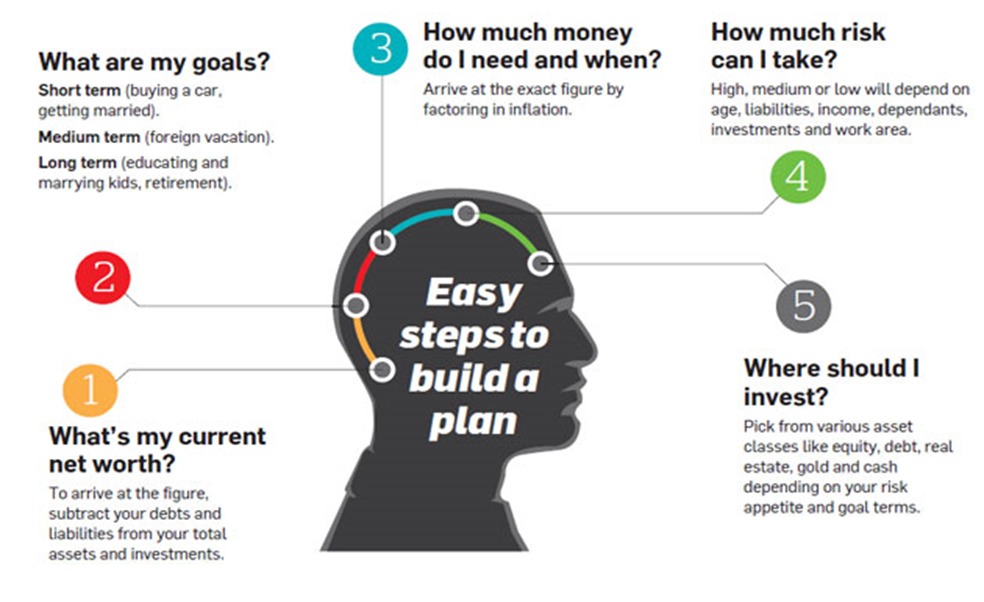

To secure your financial future, we start by understanding your current net worth and then work together to define your personal goals—whether they’re short-term needs or long-term dreams. We calculate how much you’ll need, when you’ll need it, and factor in inflation so your plans stay realistic. Based on your comfort with risk, income, and responsibilities, we help you choose the right investment mix across equity, debt, real estate, and more. Our goal is to create a plan tailored uniquely to you. Ready to Transform Your Financial Future?